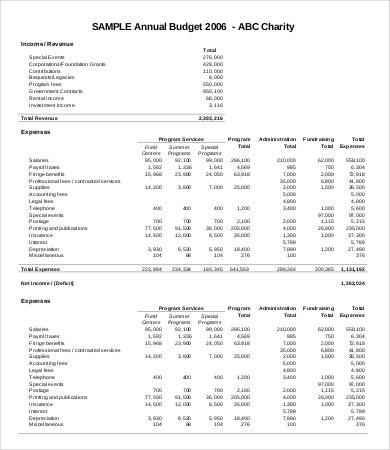

Review financial information from a number of your competitors, if available.Review industry guides and other expert publications that focus on your industry.Consider the recent monthly growth rate experienced by the company and decide if it can be continued.Here are some ways to come up with the best estimate: Estimate RevenuesĮxpected sales have a significant influence on costs, including employee headcount, but it can be very challenging to make projections accurately. Too often, companies that do complete the annual budget planning process estimate an overall percentage increase over the prior year’s actual income – this is something that should be avoided. Therefore, project completions are possible for the upcoming fiscal year. It is encouraged to incorporate feedback from each department as the results are much more likely to be accurate.

#Business budget planning update

Strategic budgeting is a skill that any good CFO will have in their arsenal. These resources can help the company craft its budget, as well as short and long-term financial goals. Having a chief financial officer, or CFO, as part of your company’s C-Suite executive team can be an asset in this process.Ī CFO will have access to and be up to date on the most recent financial data pertaining to the company. Every business, regardless of size, should have the answers to these questions to be able to plan the annual operating budget accordingly. These questions (and many others) are typical of investors, financial institutions, potential strategic partners, and financial buyers.

Will you have any significant capital expenditures soon?.Do you plan to hire additional employees?.Are you expecting margins to improve next year?.What are you projecting sales to be next year?.So why is it so important? Well, mostly because it is a process that prepares your company to answer critical questions about what the next 12 months will look like: Crafting an annual budget is one of the most important financial aspects of a business, but often gets overlooked.īusiness budget planning is an essential task that is frequently neglected at small and mid-size companies.

0 kommentar(er)

0 kommentar(er)